Cryptocurrencies have seen a crazy week with bitcoin dipping 20% after an all-time high of $42,122 on January 8th. There is supposed to be a bullish market ahead, with altcoins to follow. Time to buy the crypto dips before they fly high!

Why did Bitcoin dip on Monday?

Bitcoin dropped 20% since the new all-time high of $42,122 on January 8th. The violent sell-off saw record breaking trading volumes. While there is still potential for bitcoin to drop lower, a new influx of buyers will likely spark an uptrend. Alts didn’t follow with such a large drop, after a small drop of 5% they recovered overnight.

Bitcoin is attempting to bounce back after falling over 30% in the last few days. It is starting to make a recovery while other cryptocurrencies like Ether, Ripple and Litecoin are also creeping back up.

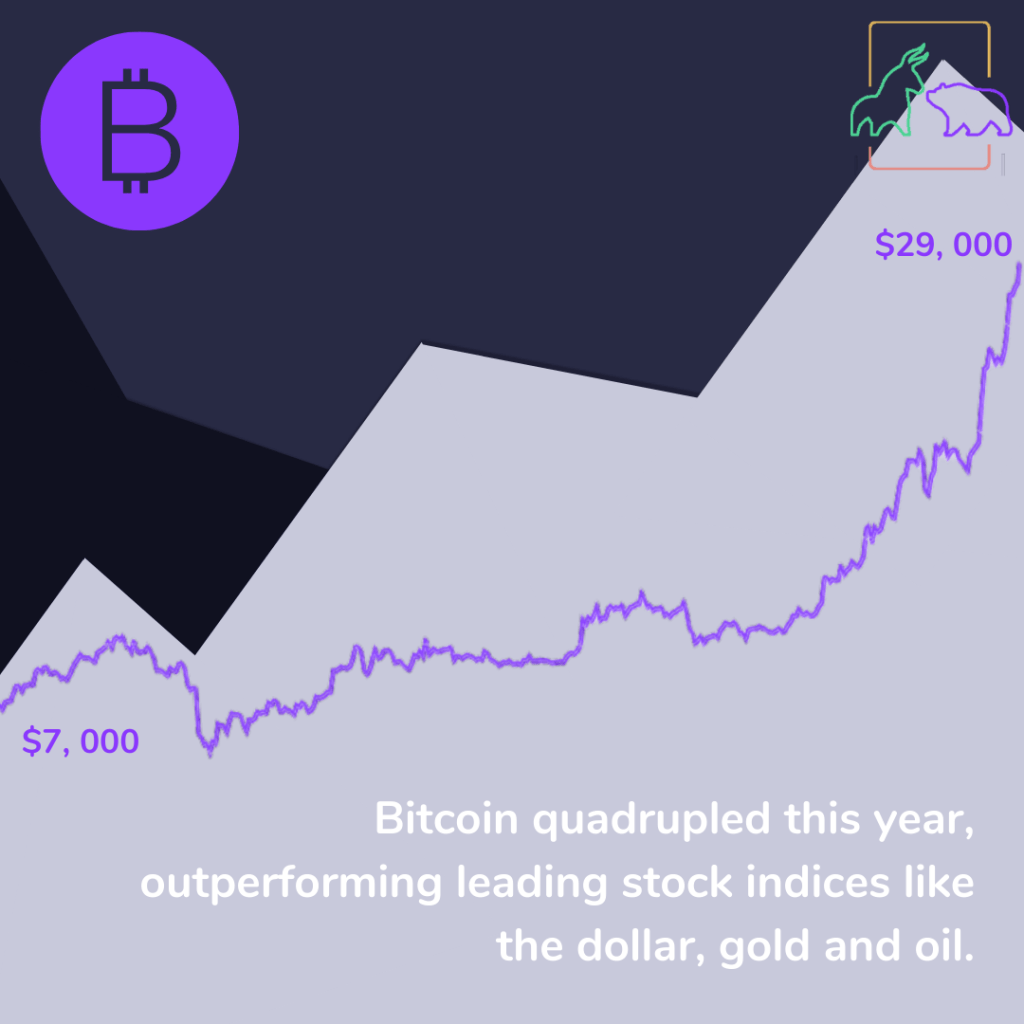

The price of Bitcoin crashed on Monday after reaching an all-time high of $42,122. Bitcoin has been growing at a phenomenal rate, seeing a 940% increase from last year’s low. This is the best performing asset in the financial market with gold only rising 25% and the S&P 500 rising 70%.

The recent volatility is likely led by the boost in popularity in cryptocurrency. The recent rally wasn’t sustainable which is why Bitcoin crashed as investors withdrew their money thinking a rise any higher without a correction would be too good to be true.

Another reason Bitcoin has dropped is the US dollar gaining strength. The US Dollar Index rose 1.5% over the past few days sparked by the US’ political crisis and the dominance of coronavirus over Northern America and other parts of the world. The $3 trillion stimulus package that should accelerate US economic recovery has led to rising interest rates, pushing up the dollar. And since cryptos are measured against the dollar, this helped make a noticeable dip.

Will we see a recovery?

Whales (large bitcoin investors) bought Monday’s price dip presenting confidence in a bullish market. Whale entities (single networks holding at least 1,000 bitcoin) rose to a new record high of 2,140 on Monday.

Some high-profile investors retain a bullish outlook too. Anthony Scaramucci, founder of SkyBridge Capital, stated the decline in bitcoin this week creates a great opportunity to enter the market. Although, Scott Minerd, an investor at Guggenheim Partners, has expressed his caution that bitcoin is “vulnerable to a setback”.

This bull run is different to those seen in the past for bitcoin due to the recent support of institutional investors. Previous spikes in volatility were the result of speculative frenzies and had little large investors to control the price change, whereas Monday’s price drop is unlikely to send away whales.

The short-term outlook or bitcoin however is not positive. David Lifchitz, investor at quantitative trading firm ExoAlpha, said “There could be another dump as outflows from the cryptocurrency exchange Coinbase Pro have dried alongside an increased transfer of coins onto exchanges,” as demand pressures decrease.

What do the stats say?

The bitcoin price correction might be ending, as several metrics hint at a new bull run. The brief dip has allowed sidelined investors to get back into the market, and with more buyers the price will go up. Following a brief consolidation period after Mondays days drop the long-term outlook looks bullish.

Some technical charts call for extension of Monday’s bitcoin drop. The Ichimoku cloud tool is great to identify trend direction and momentum. Currently we can see a continuation of the bearish trend as bitcoin is trading below the red cloud line. Chris Thomas, head of digital assets at Swissquote Bank, expects consolidation at $33,000–$36,000 range until next week. This consolidation could end with a bullish move if institutional demand perks up. The attraction of buying bitcoin at a dip may be just enough to encourage fresh buying activity.

The number of active addresses is ever increasing – this metric considers how many tokens are being transacted daily. With more investors the price of the underlying asset is sure to increase. Bitcoin active addresses figures are at an all-time-high at 1.34 million, seeing a 8.8% increase in a single day.

Similarly the number of active entries is at a high, showing investors are actively using Bitcoin’s blockchain. A massive 25% increase from the previous all-time high in 2017 can be witnessed.

So is investing in crypto worth it?

Bitcoin is the strongest cryptocurrency out there, although all cryptos have high volatility.

Cryptocurrencies avoid a centralised financial institution meaning they avoid inflation. If a government creates new money through a stimulus then inflation is sure to follow. Owning crypto is holding a stake in the value of a currency solely controlled by markets. It is more difficult to exploit or manipulate people who don’t rely on a central authority.

However, crypto is not entirely immune from inflation. Mining crypto is comparable to printing money, though, the difference between the Federal Reserve and Bitcoin minors is that the miners are rewarded for their efforts. Halving means every one ‘block’ mined is cut in half every 210,000 blocks produced, which equates to a reduction every four years. There are around 2.5 million bitcoins left to mine, are the diminishing returns worth it?

Why are cryptos unpopular with financial institutions?

Speculation has meant large pension funds and traditional investors are unlikely to hop-on the crypto bandwagon any time soon. Cryptocurrencies are not a suitable alternative to safe-haven assets and don’t help protect against risk. The high volatility and the fact that cryptos are not based on any underlying asset, only market pressures, makes them a high risk investment. Whilst more traditional investment institutions have kept away from the crypto market, hedge funds have been getting onboard due to the growth potential.

Mother of All Bubbles

The Bank of America’s chief investment strategist, Michael Hartnett, claims bitcoin is “the mother of all bubbles” concerning the recent rally. Bitcoin is an extremely crowded trade with the price being solely controlled by demand. In other words, investing in bitcoin or any other crypto for that matter is essentially putting all your eggs in one basket – even a small drop could see all your investment becoming worthless.

Bitcoin strikes as a clear frontrunner when comparing past bubbles. In the late 70’s gold saw a price surge of over 400% and nothing has gone above this level since.

Cryptocurrency cannot provide a hedge for equity investments as the price of a stock tends to move with crypto trends. Crypto can see high volatility, on Monday Bitcoin traded at $10,000 below its peak of $42,000 just days before. The steady drip of reputable investors has helped grow the bubble.

What about altcoins?

With Bitcoin pulling back from record highs, alternative cryptocurrencies are taking the spotlight. Bitcoin was 87% and ether was 78% from their all-time highs (ATH) on Jan 11th, where other coins were miles away from their ATH. This suggests there is a lot of potential for altcoins to climb higher, irrespective of bitcoin’s recent bull run.

The high profile of the bitcoin bull run has encouraged newbies to join the crypto game due to FOMO. Some beginner investors see the low price tag of altcoins and invest due to their affordability. Altcoin movements follow those of bitcoin so are still risk-on.

What do you think will happen with crypto markets? Will we see a brief stabilisation before cryptos climb higher or will the bubble be popped? Keep up to date with the latest stock market news with BullBear.