The benefits of options trading for investors

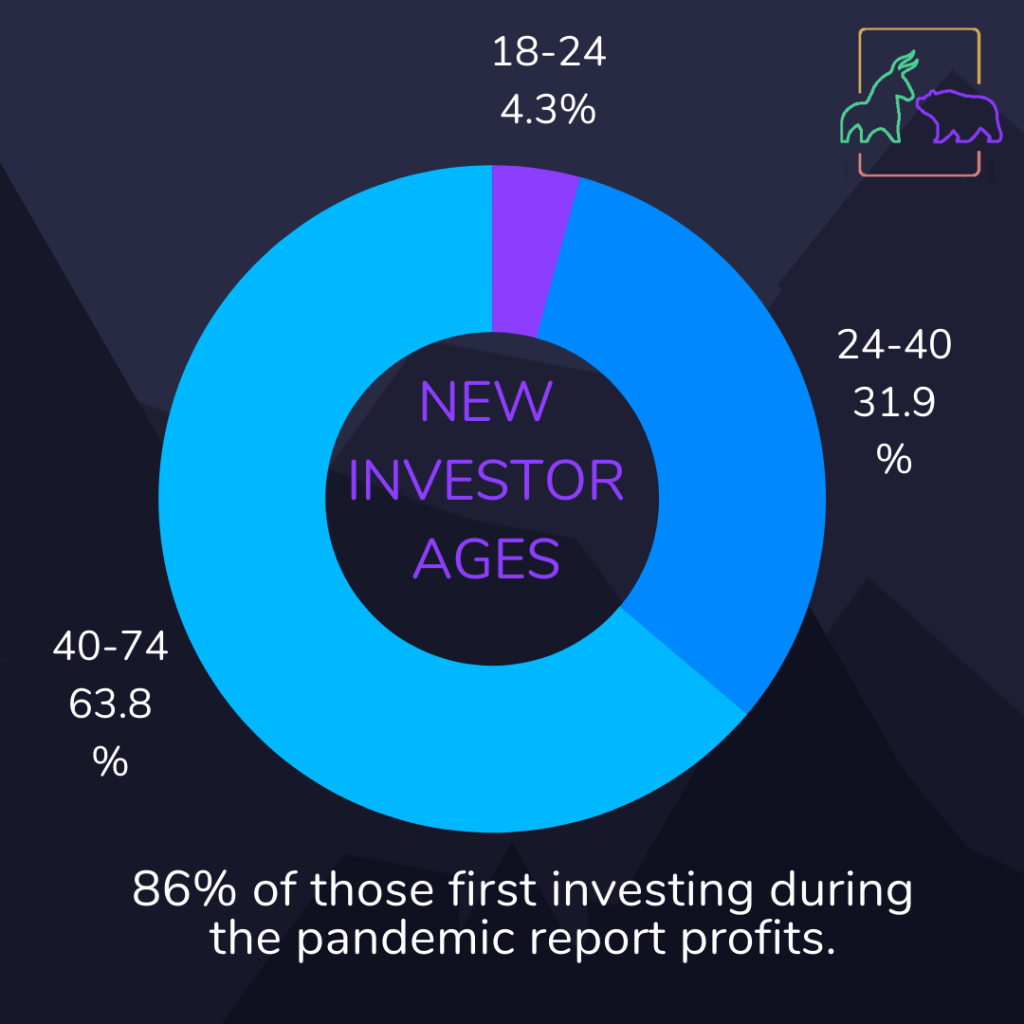

Options trading has been steadily gaining popularity in the UK over the past few years, and it’s no surprise why. This type of trading offers a wide range of benefits to investors, including the ability to hedge against market risks, speculate on market movements, and potentially earn significant returns.

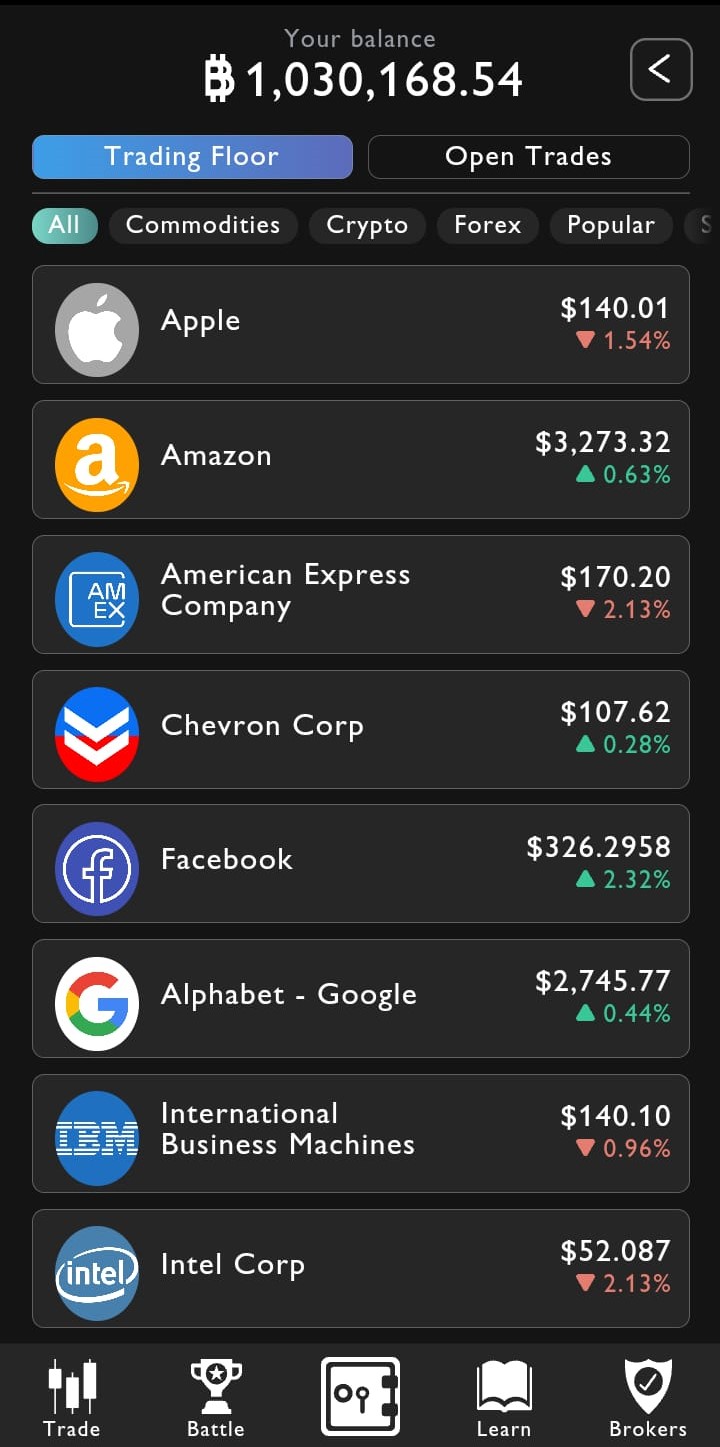

Options trading enables exposure to a broad spectrum of assets, including stocks, indices, commodities, and currencies. This versatility allows investors to diversify portfolios, leveraging market movements across various sectors.

The Benefits of Options Trading

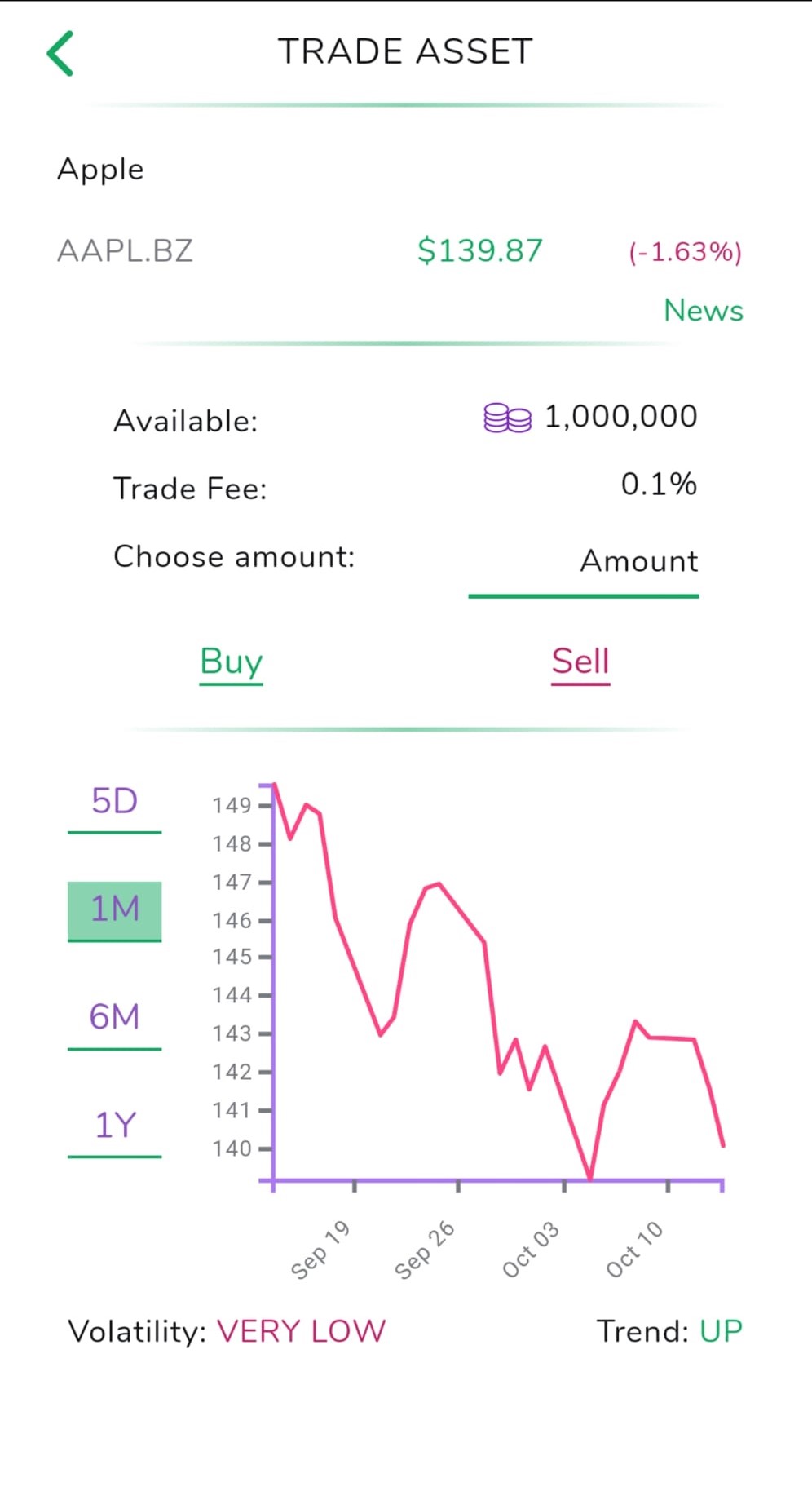

One of the key benefits of options trading is that it offers a high degree of flexibility. Investors can choose from a variety of options strategies, including calls and puts, and they can adjust their positions as market conditions change. This means that investors can tailor their portfolios to their specific investment goals and risk tolerance.

Another major advantage of options trading is that it allows investors to hedge against market risks. For example, an investor who owns a stock position can use options to protect against potential losses if the stock price were to drop. This can be especially important for investors who are concerned about market volatility or economic uncertainty.

The Risks of Options Trading

In addition to hedging against market risks, options trading also offers the potential for significant returns. Options can be used as a speculative tool, allowing investors to take advantage of market movements and potentially earn substantial profits. However, it’s important to note that options trading also carries a higher level of risk, and investors should be aware of the potential for significant losses.

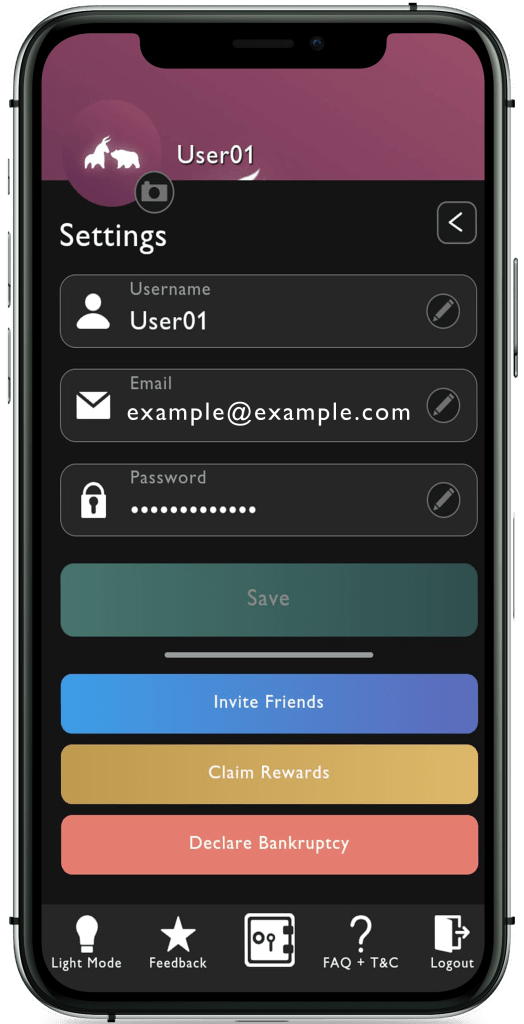

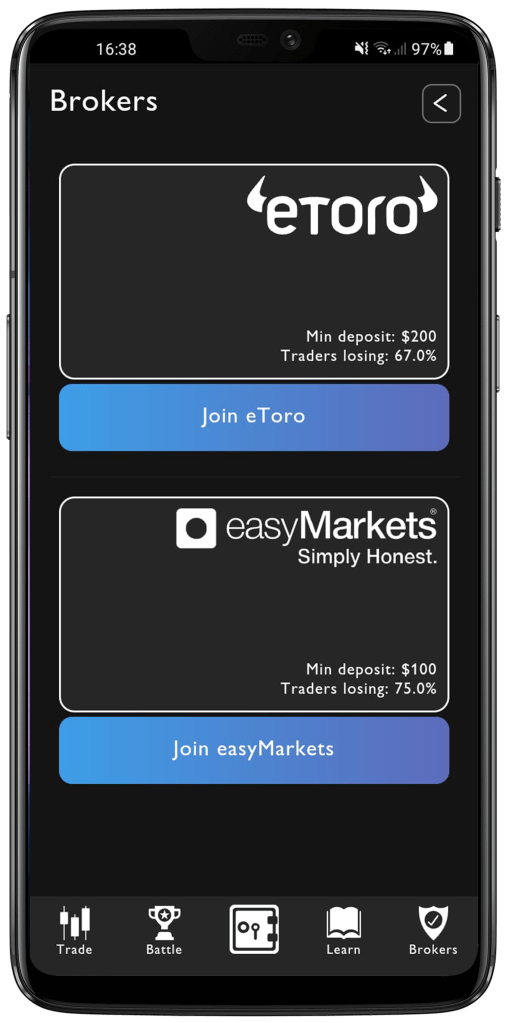

At Options Watch, our team of experienced traders and analysts provides invaluable resources. We offer real-time market data, educational content, and expert insights, aiding investors in navigating the complexities of options trading.

The role of Options Watch in supporting investors in the options market

In conclusion, the rise of options trading in the UK is a significant development for investors. This type of trading offers a wide range of benefits, including the ability to diversify portfolios, hedge against market risks, and potentially earn significant returns. At Options Watch, we’re committed to helping investors take advantage of these opportunities and achieve their financial goals.