Facebook has been on the front pages more than once recently, but how does this affect stock prices? The company has shown it is robust, powering through the pandemic and a high-profile boycott this year. Its Q3 earnings suggest nothing can stop its path, however, with the antitrust lawsuits filed by the US government, will we see a turn around?

The story of Facebook is well-known: Mark Zuckerberg, a Harvard student started Facebook in his doom room back in 2004. Since, the platform has exploded: in 2012 when the company went public shares were worth a massive $38 making Facebook worth an eye-watering $104 billion.

Recent News

Last week the Federal Trade Commission and 48 state lawyers filed separate antitrust cases alleging Facebook’s acquisition of Instagram and WhatsApp were anti-competitive, intended to stronghold Facebook’s monopoly position in social media. Yet this news didn’t affect the Facebook stock price which closed higher than opening, after riding a 2% dip.

The FTC demands: “divestiture of assets, divestiture or reconstruction of businesses (including, but not limited to, Instagram and/or WhatsApp), and such other relief sufficient to restore the competition that would exist absent the conduct alleged in the Complaint,” Essentially the FTC want Facebook broken up to restore competition and to support the devolved companies in doing so.

Another scandal that has hit the headlines was a high-profile ad boycott demonstrating tolerance of racially motivated hate speech. This was back in July and took a hit on growth in Q3.

Buy or Sell

Although Facebook is perceived as standing strong despite the antitrust lawsuits, the statistics give us a different take. Facebook’s relative strength line (blue line) has diverged from stock price since August. Overall, this means that facebook stock only matches S&P 500’s performance since mid Summer.

Amongst fears of the impending lawsuit, Facebook has tried to explain their reduction in daily active users over Q3. They found a decline in daily active users in the US and Canada from 198 million to 196 million. The company says that the pandemic is to blame, but with further lockdowns worldwide and more time for social media, will this explanation really stand?

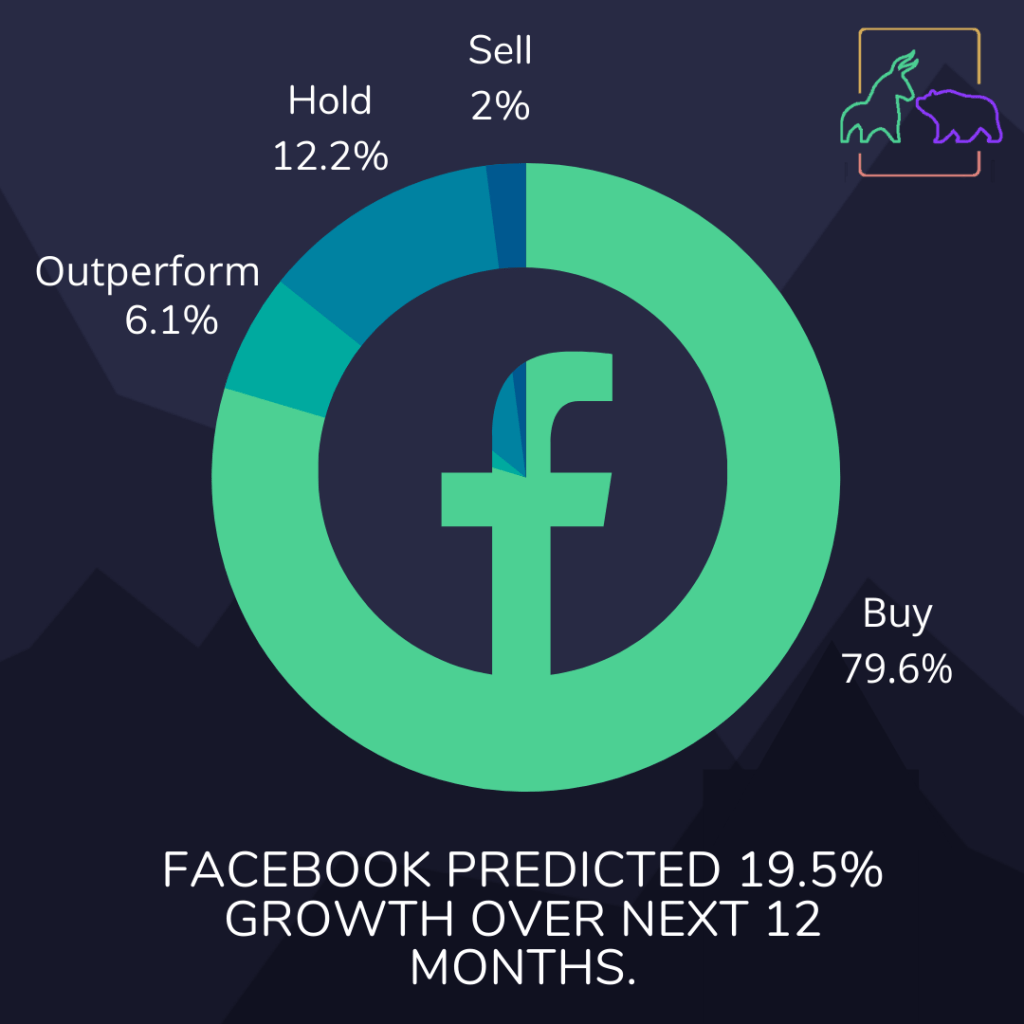

Despite all this, Wall Street analysts believe this FANG stock still has a long growth runway and has proved its stability through an economic downturn. With their strong record of stability and potential for growth Facebook stock is still a buy. But all this could change soon as the antitrust battle may break the company’s record of resilience.

Price Predictions

Despite everything, Facebook still has high potential for growth with the launch of Instagram Reels that rivals TikTok and the monetisation of Whatsapp. BC Capital Markets analyst Mahaney noted the 31%-44% increase in investment demonstrates Facebook is “investing aggressively in innovation from a position of strength.”

A staggering 98.8% of Facebook’s revenue this quarter was generated from advertising. Advertisers are crucial to the company’s success so with further damage to Facebook’s reputation will they go elsewhere? Well, unlikely, as there is not much elsewhere. Even so, advertising revenue growth remains at 20%, seeing there is potential to be unlocked. Facebook must now demonstrate it can still generate new users and keep old ones active as the reduction in North American users worried the company last quarter. Facebook’s reliance on advertising could make them vulnerable with the advertising market being severely impacted by the recession. This may be why the company withheld Q4 earnings guidance – but only time can tell.

Over the next 12 months, Facebook will rise by 36.9% based on the past 8 years of stock price. Over the same period, Facebook stock is predicted to increase by 19.5% yet this isn’t a smooth increase (as seen in the graph below) so time your entry point right.

Although Facebook’s well-established roots will get it far, constant knocks to its reputation question their stock outlook over the next 6 months. Overall, Facebook is a buy so invest now, but keep an eye on the bad press. To learn more about trading, check out BullBear.